The EU VAT Number for WooCommerce plugin is a useful extension for businesses in the European Union (EU) that need to manage VAT (Value Added Tax) on sales made to customers across different EU countries. This plugin helps store owners verify VAT numbers, ensure proper VAT handling, and comply with EU tax regulations.

Key Features of EU VAT Number for WooCommerce:

- VAT Number Validation:

- The plugin allows you to validate VAT numbers entered by customers during checkout. It connects with the VIES (VAT Information Exchange System), which is the EU’s official database for VAT number verification. This ensures that the VAT number provided is valid and registered within the EU.

- Display VAT Number Field:

- The plugin adds a dedicated field for VAT numbers during the checkout process. This field can be displayed for both B2B (Business-to-Business) and B2C (Business-to-Consumer) transactions. The store owner can choose to make this field optional or mandatory.

- Tax Exemption for Valid VAT Numbers:

- If a valid VAT number is entered during checkout, the plugin will automatically exempt the customer from VAT charges, ensuring compliance with EU VAT rules for B2B transactions. This is particularly useful for businesses that sell to other EU businesses, where VAT should not be charged on cross-border sales within the EU.

- VAT MOSS Compliance:

- For businesses selling digital products, the plugin helps with VAT MOSS (Mini One-Stop Shop) compliance. It ensures that VAT is applied based on the customer's location within the EU, which is a requirement for digital products under EU tax laws.

- Automated VAT Calculation:

- The plugin can automatically apply the correct VAT rate based on the customer’s country. If the customer is in an EU country and has provided a valid VAT number, VAT is typically not charged. If they are in a different country, the appropriate VAT rate for that country is applied.

- Customizable Settings:

- Store owners can customize how the VAT number field appears on the checkout page and whether it is required or optional. You can also configure the behavior of VAT number validation based on your specific business requirements.

- Custom Error Messages:

- The plugin provides the option to display custom error messages when an invalid VAT number is entered, helping customers understand why their number is not accepted.

- Support for Different Countries:

- While the plugin is primarily for the EU, it can be adapted to handle VAT numbers from other countries, depending on the setup. It ensures that VAT numbers are validated and handled properly, regardless of the customer's location.

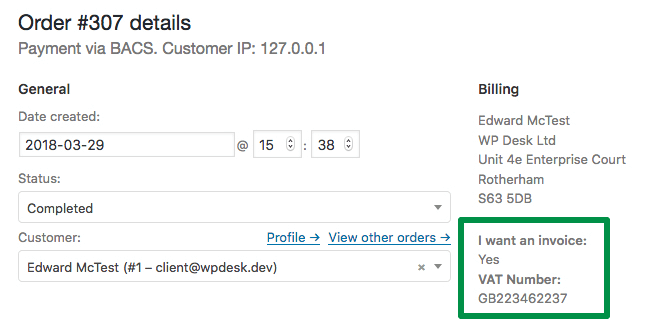

- Backend Order Management:

- Store owners can view the VAT number provided by customers in the order details in the WooCommerce backend. This makes it easy to verify VAT numbers and track sales to businesses.

- Custom Tax Handling:

- The plugin allows for advanced tax handling configurations. For example, you can set up specific tax rates based on the country or region of the customer and manage VAT settings for physical goods, digital products, or services.

Benefits of Using EU VAT Number for WooCommerce:

- Tax Compliance:

- The plugin ensures that your store complies with EU VAT rules, including VAT MOSS for digital goods. By automatically exempting B2B sales to customers with valid VAT numbers, it reduces the risk of errors or non-compliance.

- Simplified VAT Handling:

- The plugin automates VAT number validation and tax exemption, making it easier for business owners to handle taxes on sales made to customers in different EU countries.

- Improved Customer Experience:

- Customers who provide valid VAT numbers will not be charged VAT, which helps increase trust and satisfaction. A seamless, automated process helps customers quickly complete their purchase without manual intervention.

- Reduced Risk of Errors:

- Automated VAT number verification reduces the risk of incorrectly applying VAT to transactions and ensures that the proper tax rates are applied for both domestic and international customers.

- Easy to Implement:

- The plugin integrates seamlessly into WooCommerce, and store owners can start using it with minimal setup. Once configured, the plugin runs in the background, automatically handling VAT validation and calculation.

- Time and Cost Savings:

- By automating the VAT number verification and exemption process, store owners save time and avoid the need for manual intervention, reducing administrative overhead and the risk of penalties from tax authorities.

Use Cases:

- B2B Sales within the EU: If your store sells products or services to other businesses in the EU, this plugin is essential for ensuring that VAT is not incorrectly charged on cross-border transactions, in line with EU VAT rules.

- Selling Digital Goods: Businesses that sell digital products across the EU benefit from this plugin as it ensures compliance with VAT MOSS, which requires VAT to be charged based on the buyer’s location.

- E-commerce Stores Targeting EU Countries: For stores that target customers in multiple EU countries, the plugin automatically handles VAT based on the customer’s location, saving the business from having to manually configure tax rates.

- Non-EU Businesses Selling to the EU: If you’re based outside the EU but sell to EU customers, this plugin allows you to correctly handle VAT and make sure that transactions are compliant with EU tax laws.